Most income tax deductions for individuals require that you spend cash for the deduction – pay your property tax, write a check to charity, etc. The 2017 tax law provides a new significant deduction for individuals (and trusts) that does not require that you spend cash. There is now a 20% deduction for Qualified Business Income that you may take on your personal return.

The 2017 tax act reduced the tax rate for regular or C corporations to a flat 21%. S corporations and LLC’s (partnerships) do not pay any income tax as does a C corporation but rather pass their taxable income on to their owners to report on the owner’s personal tax return. Because the new 21% corporate tax rate will not benefit S corporations and LLC’s the new law contains the 20% Qualified Business Income deduction to reduce the effective tax rate on income from certain types of S corporations and LLC’s.

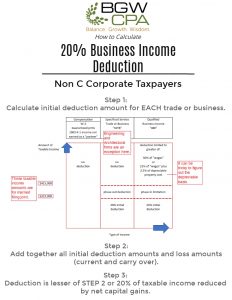

If you are an owner of a Qualified Business, then you still report your share of the business taxable income on your return but are permitted to take a separate deduction for up to 20% of the income you report. This deduction is not an itemized deduction, so it is still available to you even if you use the standard deduction. Rather, it falls in a new position on your return – after adjusted gross income but before itemized deductions.

For higher income individuals, the 20% deduction can be limited by your share of W-2 wages and fixed assets from the S corporation or LLC. Further, it is limited to 20% of your taxable income. If your qualified business is a personal service type business – health, law, financial services, consulting, accounting, etc. then your 20% deduction is lost entirely at higher income levels.

The planning opportunities for getting the most out of this new 20% deduction are numerous –

- S corporation owners will need to consider wage adjustments if you are subject to the wage limitation

- S corporation owners will need to review their existing compensation to determine that it is reasonable and not either significantly over or under industry standards

- If your main business is a personal service type business, there may be parts of the operation that are not personal service and with planning can be established as a separate business that qualifies for the 20% deduction

- High income individuals that are subject to the W-2 wage or fixed asset limit may benefit from an election to aggregate two or more business activities to maximize their 20% deduction

- C corporations should evaluate if the new 21% corporate tax rate or the new 20% Qualified Business Income deduction is more favorable

- Certain activities that at first may appear to be personal service may not meet the definition upon close analysis, thus making the 20% deduction more likely

- Some income producing activities may not, as currently arranged, qualify as a business activity and thus not be eligible for the 20% deduction; adjustments to the activity should be considered that could result in qualification

With any new tax benefit comes complexity; first to determine eligibility and secondly to comply with the reporting requirements. The planning opportunities previously listed will assist with the eligibility. The reporting complexity will require additional data be reported for each owner on their Schedule K-1 for the Qualified Business. The items to be reported are not easily identified in most existing accounting records so will require additional analysis to arrive at the required amounts to be reported.

This new Qualified Business Income deduction can reduce the maximum effective tax rate on S corporation and LLC income from 37% to 29.6%. A significant reduction that should justify an investment of planning effort to get the most from this cash free tax benefit.