As we're all hearing about various proposals to increase jobs (e.g. should the government go on an infrastructure spending spree – a la the New Deal or should we cut taxes to stimulate growth) occasionally the press references the Laffer Curve. The purpose of this blog post is to educate the middle market business owner on the Laffer Curve and its potential impact on you. First, a little history.

The Laffer Curve is not a new concept, in fact the author, Arthur Laffer, referenced the work of a 14th century North African mathematician. It was popularized during the 1970s as an argument against the tax increase proposed by then President Gerald Ford although it had been used in debates before during the 1920s as an argument for lowering taxes.

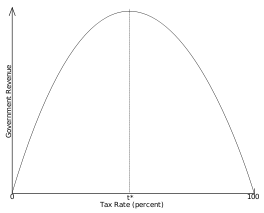

In a nutshell, the Laffer Curve describes the relationship, using statistical analysis, between tax rates and government revenue in order to determine at what tax rate are government revenues maximized. Huh? It's actually a pretty simple thought process. Clearly at a 100% tax rate people would not be incentivized to work, as all of their money would go to paying taxes, therefore there is no government revenue. At a 0% tax rate there is no government revenue, as there is no tax rate. Somewhere in between government revenue is maximized without impeding growth in the overall economy.

Most economists have argued that we should increase the tax rate in order to reduce the deficit as we are on the left side of the curve (you don't want to be on the right side). Many of the same arguments, including the Congressional Budget Office, have looked at hypothetical tax cuts and have concluded that most cuts actually cause more debt and deficits, not less, as there isn't enough corresponding increase in economic growth (which drives government revenue). I'm not arguing whether or not they are right or wrong – just trying to explain the concept.

So what's the impact of the debate on you, the middle market business owner? Well, it's very similar to the debt ceiling debate and the national deficit. Unless massive structural changes occur OR we have a massive economic recovery, tax rates have to go up in order to pay for what we currently have and our future obligations (e.g. like your social security entitlement). That's the bad news. The good news is that although there is wide debate in terms of the shape of the curve, many economists have consensus on a marginal tax rate of around 32% and 35%. That would correspond to a likely 5% or so increase over the effective tax rate of the top 10% of all US taxpayers, and about a 12% increase overall. Most of you reading this are going to be in the top 10% - so that's your potential increase – which isn't widely different from a repeal of the Bush Tax Cuts.

What do you think – does a tax cut create a job or stimulate the economy? Or do we just need to know one way or the other so we can plan accordingly?