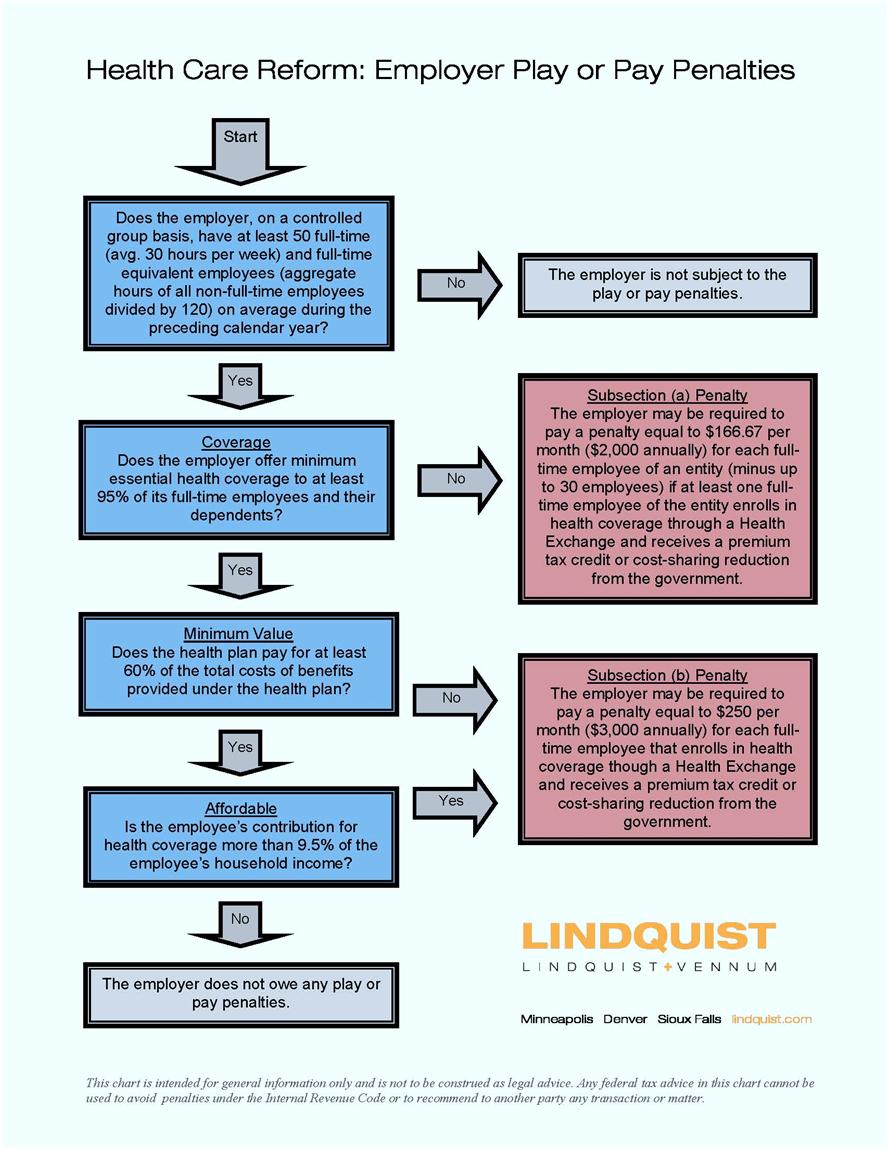

Love it or hate it, the 2010 Patient Protection and Affordable Care Act (a.k.a. Obamacare) is set to take effect in 2014 – private businesses and owners need to prepare themselves. The Act represents a significant government expansion and regulatory overhaul of America's healthcare system, particularly in an area which has come to be known as the "Play or Pay" mandate, a series of monetary penalties that can be imposed on employers should they fail to meet the meet the guidelines set forth in the Act. 2014 may still seem a bit far off, but keep in mind that the structure of your 2013 workforce will determine how your business is evaluated in 2014. The time to start planning for the Affordable Care Act is now.

Beginning in 2014, businesses that employ 50 or more full-time and full-time equivalent employees (working an average of 30 hours/week, based on the previous calendar year) must offer "minimal essential coverage" to at least 95% of those employees and their dependents. Complete failure to do so may result in a penalty of $166.67 per month times the number of full-time employees in excess of 30 ($2,000 annually) if at least one of those employees enrolls in health coverage through a Health Exchange and receives a premium tax credit or cost-sharing reduction from the government. This is the Subsection (a) Penalty. Furthermore, even if minimal essential coverage is offered but does not provide minimum value (health plan pays less than 60% of the total cost of benefits), or is unaffordable to employees (employee contribution is greater than 9.5% of household income), a penalty of $250 per month may be assessed for each employee that enrolls in health coverage through a Health Exchange and receives a premium tax credit or cost-sharing reduction from the government. This is the Subsection (b) Penalty.

The IRS recently issued a series of regulations on the Play or Pay mandate that is designed to offer guidance to businesses in this time of transition. The list is lengthy and best discussed with your tax professional. Do not wait for the Act to fully take effect before considering changes to your business structure. The following graphic – forwarded to me by a health insurance broker colleague, provides a decision making flowchart that you can follow to understand your particular implementation of the Affordable Care Act.