The IRS released on Monday Notice 2018-14, providing more guidance on the withholding rules we brought to your attention last week. This further guidance is an important step in successfully implementing the new tax law that the president signed last month.

Here are the 3 key elements of the most recent notice that every business owner should know.

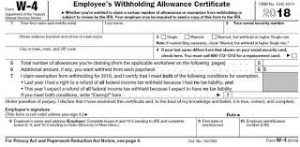

- Use of 2017 Form W-4, Employee’s Withholding Allowance Certificate

Employees file Form W-4 to claim exemption from withholding, and the form is usually effective for a tax year up until February 15 of the following year. But when the IRS issued the 2018 withholding tables, it announced it was in the process of revising the 2018 version of Form W-4 to reflect the changes in the Tax Cuts and Jobs Act, and may not finish the new version until after Feb. 15, 2018. This left a lot of people wondering how to file a W-4 for 2018. The newly released guidance addresses the issue.

The effective date of the 2017 Form W-4 has been extended to February 28, 2018. Taxpayers who wish to claim the exemption for 2018 should use the 2017 W-4 form (modified as instructed in the notice) until 30 days after a 2018 version of Form W-4 is issued by IRS. - Temporary suspension of the 10-day rule

IRS regulations require employees to notify their employers of changes in status that affect the number of withholding allowances they will claim within 10 days of the event. Three important changes to note:

A) The IRS is changing the 10-day period to file new Forms W-4 until 30 days after the 2018 forms are released.

B) Employees who have a reduction in the number of withholding allowances solely due to the changes made by the Tax Cuts and Jobs Act are not required to furnish employers new withholding allowance certificates during 2018.

C) Employees may voluntarily file new Forms W-4 to update their withholding in response to the Act and can use the 2017 form until 30 days after the 2018 form is released.

- Reduced rate of optional withholding on supplemental wages

Because the new tax law lowered income tax rates beginning in 2018, the rate that employers should withhold on supplemental wages is also lowered from 25% (the rate in effect from 2005 to 2017) to 22%. This new lower rate should be implemented as soon as possible, but no later than Feb. 15, 2018.

Need to correct overwithholding? You have the option to correct overwithholding at the old 25% rate for wages paid between Jan. 1 and Feb. 15. Just reach out to us for help, as the rules surrounding overcollection can be confusing.

Note that the IRS also addressed withholding on periodic payments which may affect you personally (and not as a business owner). Periodic payments are generally pension and annuity payments made for more than 1 year that are not eligible rollover distributions. Under previous law, withholding on periodic payments for which no withholding certificate was in effect treated the payees as a married individual claiming three withholding exemptions. But because the new tax law no longer provides personal exemptions, the rule will be changed to provide for withholding -- assuming the payee is a married individual claiming three withholding allowances.

The Tax Cuts and Jobs Act significantly overhauled the tax code, and we’re just now beginning to see how difficult and time consuming it will be to understand and implement the changes. Stay tuned to our blog and news section for clear, up-to-date information on the policy shifts that affect you and your business.

Questions or comments on this new guidance? Comment below!