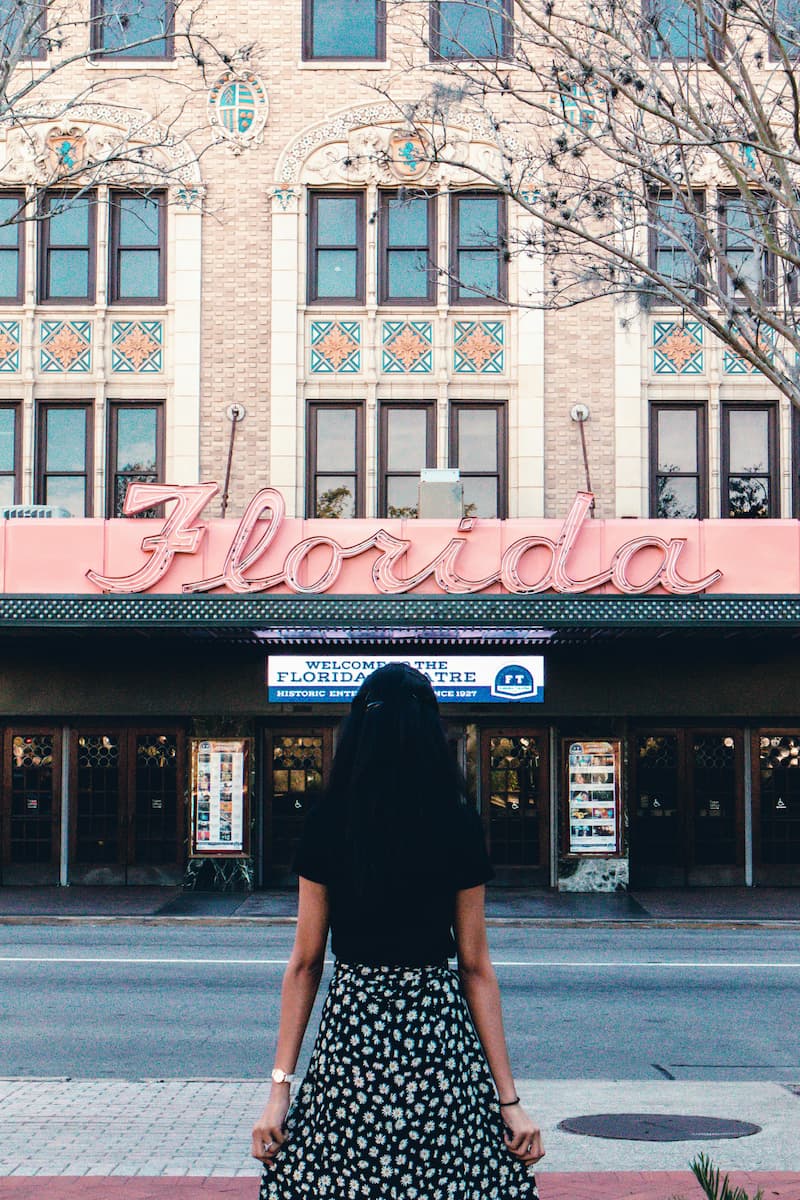

If you’re planning on moving from a high-tax state to a low-tax state, you’re not alone. Data on interstate migration shows Americans are moving away from high-tax states to lower-tax states in fairly large numbers. Moving to one of the income-tax-free states like Florida, Nevada, or Texas is a tempting prospect for someone in, say, New York, with its top income tax rate of 8.82%, or California, with its top rate over 13%. And, indeed, the TCJA made moving even more enticing with the new $10,000 cap on the state and local deduction on federal taxes.

If you’re planning on moving from a high-tax state to a low-tax state, you’re not alone. Data on interstate migration shows Americans are moving away from high-tax states to lower-tax states in fairly large numbers. Moving to one of the income-tax-free states like Florida, Nevada, or Texas is a tempting prospect for someone in, say, New York, with its top income tax rate of 8.82%, or California, with its top rate over 13%. And, indeed, the TCJA made moving even more enticing with the new $10,000 cap on the state and local deduction on federal taxes.

But, successfully parting ways with a high-tax state may not be as easy as you think.

States such as New York and California, among others, employ something called residency audits to test your new residency status: Did you actually move to a new state and plan to make it your permanent home, or did you just buy or rent a part-time house in an effort to dodge taxes? The burden of proof is on you.

Am I at risk of a residency audit?

Technically, anyone who moves from a high-tax state could be audited, but the risk is substantially higher for individuals who:

- moved to a state with a substantially lower tax burden.

- still have a home in, or business ties to, the old state.

- moved just before selling a business, valuable stock, or other lucrative assets.

- are in a high tax bracket.

Basically, the more you have to gain from a move away from a high-tax state, the more risk you’ll face, and the more careful you’ll have to be about creating a paper trail that proves your intention to live in the new state.

If you don’t think states are serious about this, think again. New York conducted about 3,000 audits a year between 2010 and 2017, collecting around $1 billion, according to Monaeo, a tech company that sells an app for tracking and proving tax residency. The state looked at everything from cell phone records to social media feeds to vet and dental bills in verifying residency. More than half of all people audited lost their case.

What will auditors look for?

There’s a common misperception floating around that you only need to spend 183 days of each year outside of the former state to win a residency audit. This is simply not true. If you spend more days in the high-tax state than you do elsewhere, you still could be considered a resident.

Take extra precautions if you own homes in multiple states or travel a lot. There’s no hard and fast rule, but spending at least twice as much time in the new home state as the old one can really help your case.

States generally have two tests to assess residency: statutory -- that’s where the 183 days thing comes in -- and domicile, which considers 5 key aspects that determine your true home:

- Home location: You can have multiple residences but only one true domicile.

- Business headquarters location: If you maintain an office in the old state where you’ve maintained headquarters for your business, an auditor can claim you’re spending plenty of time there.

- Time out of state: Again, spending 183 days in the new state isn’t enough. A ratio of 2:1 days (in new state vs. in old state) is helpful.

- “Near and dear”: Where is your stuff? Auditors expect to see moving bills.

- Family: Where your minor children and spouse claim residence will impact where auditors assume you actually live.

Don’t assume formal invoices and mortgage statements are all you’ll have to furnish. Auditors look at a wide range of factors for evidence of where your true home lies. Are you still seeing doctors and dentists in your old state? Does your family celebrate holidays there? Where do you keep your most treasured items — your photo albums, family heirlooms, pets? Where’s your safe deposit box? The questions can get personal and trip you up.

I really did move with good intention. How do I prove my case?

A substantial paper trail will make or break your case. Register to vote, get a driver’s license in your new state, change vehicle registrations, update the address where you receive bank statements, bills, and other mail, and revise your estate planning documents to reflect the laws of your new state.

Maintain the ordinary documents, too. Cell phone records -- which can show where you were each day in question -- can be subpoenaed by tax authorities along with credit card receipts, travel records, toll receipts, and so on. Having everything on-hand will make life much easier.

Keep in mind that there is no statute of limitations if a state finds you should have filed a return and didn’t, so maintain records for as long as you possibly can. Digital storage can be extremely helpful in your efforts.

How else can I mitigate my risk?

Consult a tax professional who specializes in high-wealth, business-owning individuals and who is experienced in residency audits, especially if you’ll be keeping a home or business in your old state or if your latest move won’t be your last. If you start in New York and move to Florida, but residency auditors don’t catch up to you until you’ve moved again to Texas, your time in Florida could be deemed temporary, and you could owe NY taxes for that time period. An experienced CPA team will help keep you in compliance and guide your steps to ensure you pay as little tax as possible.

Be excited but mindful of making a move from a high-tax state to a low-tax state. Opportunities abound in the new location. You just have to keep your head about you and understand that auditors may very well be watching.