|

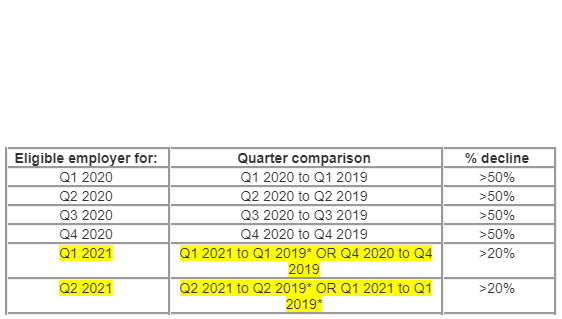

We’ve had a lot of questions from our clients about the Employee Retention Tax Credit and the Families First Coronavirus Response Act tax credits. The tax credits are substantial and are worth looking into. Let us first say: BGW WILL LET NO CREDIT GO UNCLAIMED! We have had a lot of requests about these credits, and our intent is to help claim them. Here are a few tips we think you'll find helpful: Employee Retention Tax Credit: If you did not qualify for a 2nd round of PPP funding, YOU DO NOT QUALIFY FOR RETROACTIVE TAX CREDITS. This is because the ‘bar’ you must pass is that the gross receipts test is > 50% -- thus if you weren’t down > 25%, you weren’t down > 50%. You may qualify for the credit prospectively IF Q4 2020 was < 20% of Q4 2019 based on the safe harbor provision. See table below: |

|

|

If you qualify prospectively based on this safe harbor provision, let your payroll company know, and they will reflect the credit in your payroll tax filings – which is where it ‘shows up.’ FFCRA Tax Credits: This is not a comprehensive list, but if you met one of the following conditions, you may qualify for the tax credit:

Likely, to qualify, you’d need to make some changes to your FMLA policy, so it’s a little more work that will have to be done if you didn’t already change your policies. For this credit, it was mandatory in many circumstances that you offered leave, paid, in 2020. It’s optional in 2021, but the credit still applies. Again, contact your payroll company, and they can help you to ‘flag’ people that qualify going forward and can instruct on the amendment process. If you think you qualify and would like assistance, or you just have questions in general, please reach out to us. |