As a parent, you have to protect your family when you are alive and when you are gone. The best and most comprehensive way to do this is to come up with a proper estate plan like a trust fund. A trust fund helps you to plan your estate by establishing a legal entity to hold your property and assets for you.

When you create a trust fund, you will identify a third party, known as the trustee, and task them to manage your estate. So, how does estate and trust planning work? This article talks about estate and trust planning and how it will benefit you.

How Does Estate and Trust Planning Work?

While nobody wants to think about their demise, it is important to have a proper plan for the future, especially for the ones you leave behind when your time comes to go. That’s where estate and trust planning comes in handy. Estate planning involves appointing someone to manage your assets when you are gone or incapacitated. A typical estate plan includes a will, an assignment of the power of attorney, a health care proxy, and a trust fund.

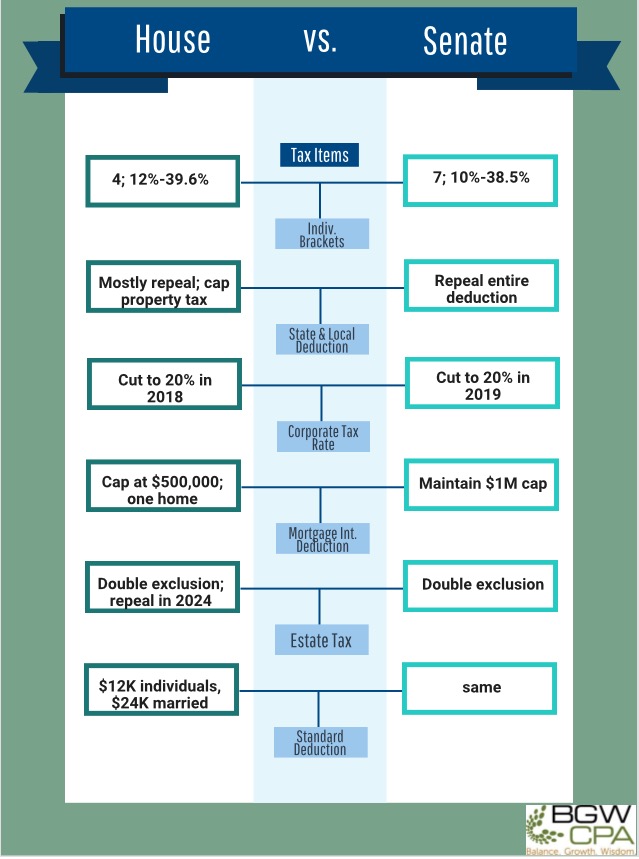

A will is a legal document that outlines your wishes regarding how your assets should be carried out when you are gone. The power of attorney and health care proxy allows you to pick someone you trust to decide on your behalf when you are dead or incapacitated. This person will have the authority to manage your possessions and financial matters. The health care proxy, also referred to as medical power of attorney, gives the person you choose the authority to make decisions about your medical state when you are incapacitated. On the other hand, a trust fund is a tool for passing your assets and money to your heirs. Unlike a will, a trust is hassle-free, as it doesn’t have to be processed through a court. Therefore, it avoids many costs and delays experienced when processing a will. A trust fund also gets around some of the taxes attached to an inheritance.

Importance of Estates and Trust Planning

One of the benefits of hiring estates and trust planning services is that you are assured that your beneficiaries will be protected when you are dead. It also gives you peace of mind knowing that your possessions will go to the rightful heirs, including young kids who need your protection when you are gone. An estate plan also helps you eliminate family messes when you are gone and spares your heirs a big tax bite.